Optimizing Your Check Out Process with a Reliable 2D Payment Gateway

Optimizing Your Check Out Process with a Reliable 2D Payment Gateway

Blog Article

A Comprehensive Check Out the Functionality and Benefits of Executing a Settlement Gateway

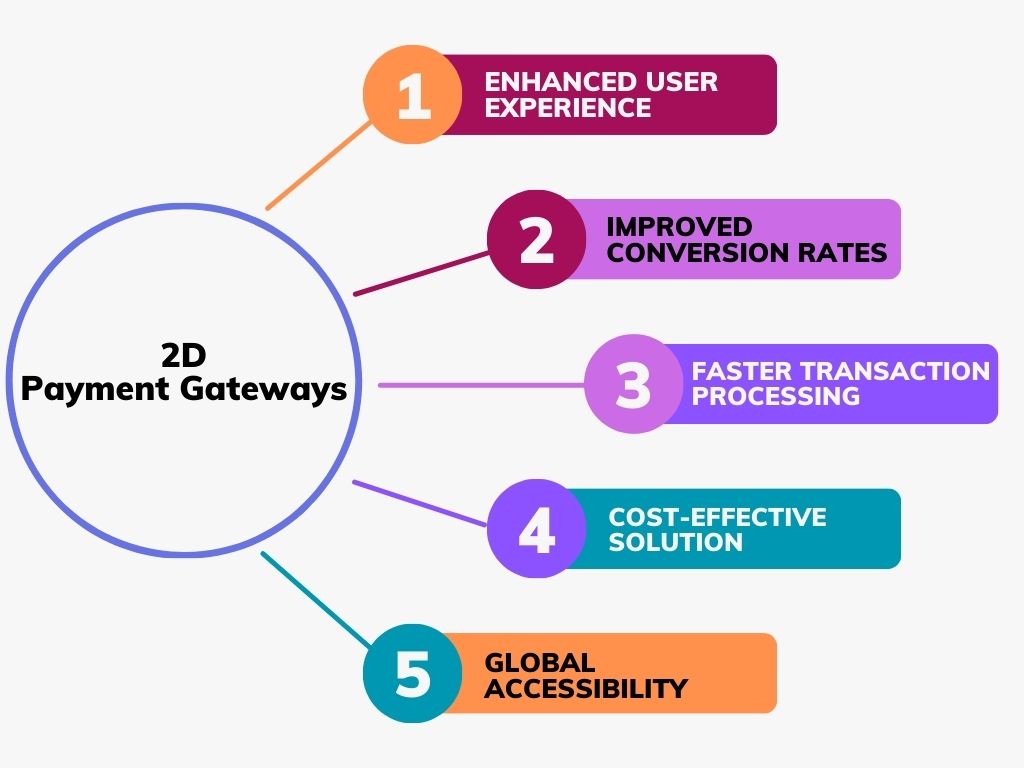

The execution of a repayment gateway stands for an important improvement in the world of digital purchases, providing services not just enhanced protection but likewise a more effective handling mechanism. By incorporating features such as multi-payment support and real-time purchase capabilities, organizations can dramatically improve client satisfaction while decreasing the risk of cart abandonment. In addition, the ability to gain access to in-depth analytics can educate operational enhancements and strategic decisions. The complete extent of advantages expands past these preliminary benefits, increasing necessary inquiries concerning the more comprehensive effects for organization growth and consumer count on.

Recognizing Repayment Portals

The essence of modern shopping depends upon the seamless combination of settlement entrances, which serve as the important avenues between consumers and merchants. A settlement gateway is an innovation that assists in the transfer of details between a repayment website (such as a site or mobile application) and the bank. This system makes certain that sensitive information, including bank card details, is firmly sent, hence maintaining the stability of the purchase.

Settlement gateways are crucial for processing on the internet repayments, enabling clients to full purchases successfully while giving vendors with an automated remedy for managing financial deals. They sustain various settlement approaches, including charge card, debit cards, and alternative repayment options, satisfying diverse customer choices.

Furthermore, settlement gateways enhance the overall shopping experience by offering features such as real-time purchase handling and scams discovery systems. Comprehending the performance of payment gateways is crucial for any kind of company looking to prosper in the competitive landscape of on the internet retail.

Trick Attributes of Repayment Entrances

An extensive understanding of payment entrances additionally involves identifying their crucial functions, which significantly boost both performance and individual experience. One of the leading attributes is purchase processing speed, which allows vendors to complete sales quickly, therefore minimizing cart abandonment rates. In addition, repayment portals help with a multitude of settlement methods, including credit report cards, debit cards, and digital wallets, providing to a diverse client base.

Another crucial feature is the easy to use user interface, which streamlines the settlement process for customers, making it easily accessible and intuitive. This simplicity of use is matched by robust assimilation capabilities, allowing smooth connection with numerous shopping platforms and point-of-sale systems. Many payment entrances supply customizable checkout experiences, permitting companies to line up the settlement procedure with their branding.

Real-time reporting and analytics are also vital features, supplying vendors with insights right into deal trends and client actions, which can educate service approaches. Scalability is a crucial particular, allowing repayment gateways to expand along with a service, accommodating increased purchase volumes without endangering performance - 2D Payment Gateway. Generally, these key attributes highlight the importance of picking a payment portal that aligns with business requirements and enhances the general consumer experience

Safety And Security Actions in Settlement Processing

Guaranteeing safety in settlement handling is critical for both consumers and merchants, as it safeguards delicate monetary information versus fraud and cyber hazards. Payment gateways employ complex safety and security steps to produce a robust framework for safe purchases.

In addition, settlement portals make use of Secure Outlet Layer (SSL) innovation to develop protected connections, additionally shielding information traded between the consumer and the vendor. Tokenization is one more important measure; it changes delicate card info with a distinct identifier or token, reducing the danger of information violations.

Advantages for Companies

Services can substantially profit from the assimilation of payment entrances, which enhance the here are the findings deal process and improve operational effectiveness. One of the main advantages is the automation of repayment processing, decreasing the need for manual treatment and minimizing human mistake. This automation permits organizations to concentrate on core tasks instead of administrative tasks, inevitably enhancing efficiency.

Furthermore, repayment gateways facilitate different payment approaches, consisting of charge card, electronic budgets, and bank transfers. This flexibility caters to a more comprehensive client base and motivates higher conversion rates, as customers can select their recommended repayment approach. Moreover, settlement gateways frequently offer comprehensive coverage and analytics, allowing companies to track sales trends and consumer behavior, which can notify critical decision-making.

Repayment entrances improve protection actions, shielding delicate economic details and minimizing the risk of fraudulence. Overall, integrating browse around this site a payment portal is a critical action that can lead to raised growth, efficiency, and success possibilities for services.

Enhancing Customer Experience

How can settlement portals boost the consumer experience? By improving the payment process, settlement portals significantly improve the general shopping trip.

In addition, settlement entrances sustain several settlement techniques, including charge card, electronic purses, and bank transfers, dealing with varied consumer choices. This versatility not only satisfies the requirements of a wider target market however also cultivates a feeling of trust and satisfaction amongst users.

In addition, a safe payment setting is vital. Payment portals employ advanced file encryption modern technologies, guaranteeing consumers that their delicate info is protected. This degree of safety builds confidence, encouraging repeat business and consumer commitment.

Moreover, many payment gateways provide real-time transaction updates, enabling consumers to track their settlements immediately. This transparency improves interaction and minimizes uncertainty, contributing to a positive consumer experience. In general, by applying a effective and secure repayment portal, businesses can significantly improve consumer complete satisfaction and commitment, inevitably driving growth and success in a competitive market.

Conclusion

In recap, the execution of a payment gateway provides many benefits for organizations, consisting of streamlined deal processes, improved safety, and comprehensive analytics. Ultimately, settlement portals serve as vital devices for modern ventures aiming to prosper in a competitive electronic industry.

In addition, payment reference portals assist in a multitude of payment methods, including debt cards, debit cards, and electronic pocketbooks, providing to a diverse customer base.

Lots of payment entrances supply customizable checkout experiences, permitting businesses to straighten the payment process with their branding.

Furthermore, repayment entrances promote various settlement approaches, including credit cards, electronic budgets, and bank transfers. By enhancing the payment process, settlement gateways dramatically improve the overall buying trip.In addition, several repayment gateways provide real-time purchase updates, allowing consumers to track their payments quickly.

Report this page